The record vehicle sales of the past few years combined with the consumer preference for holding onto cars for longer has created a massive volume of cars about to reach peak age for vehicle retirement.

In 2019 and in the coming years vehicle retirement is going to be a topic you may become familiar with when talking or reading about the auto industry in America. Previously, in the Wreckonomics™ conversation we covered the study that found Americans are holding onto their cars longer. By connecting these two almost parallel commentaries of consumer preference we understand that we are about to reach a point where more vehicles than ever are about to reach the end of their useful life.

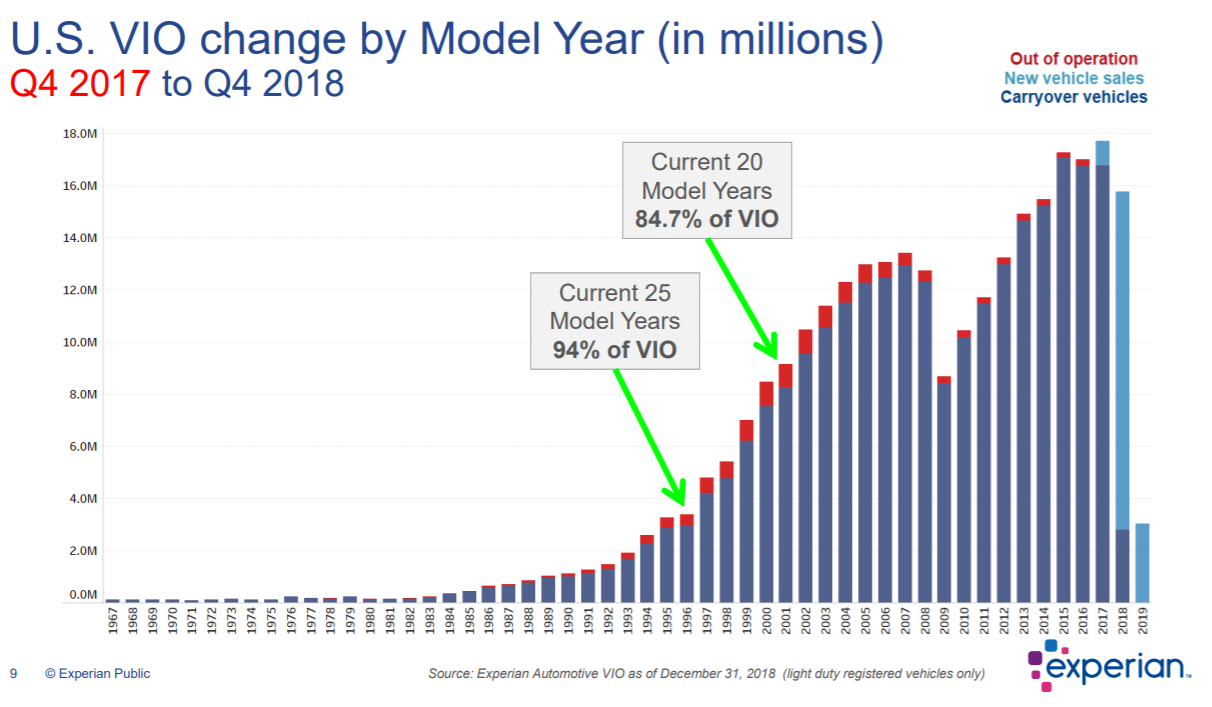

At the close of 2018, the reported volume of U.S. vehicles in operation (VIO) has grown to over 275 million. This is an increase of almost 4 million vehicles since last year and over 11 million vehicles in just two years. Advanced Remarketing Services has been tracking vehicles in operation in our Wreckonomics conversation and its effect on the overall vehicle landscape. For years the discrepancy between vehicle sales and retired vehicles has been an expanding delta contributing to the congestion on U.S. roadways we see today. That’s not just a metaphor for VIO there is literally traffic everywhere!

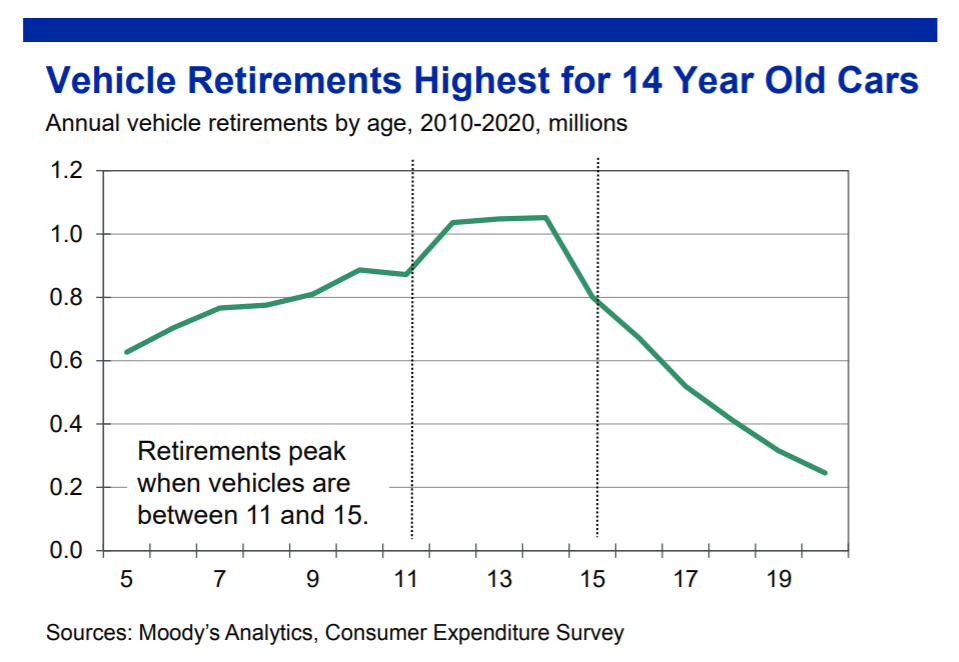

Over the next few years we are expected to reach the apex of vehicle retirement. Currently the peak retirement age for vehicles is between 11 and 15 years old with 14 year old cars being the most common found model year.

Effect of Vehicle Retirement Apex Age on Auto Industry

With the average age of vehicles being 11.6 years old there are more vehicles approaching peak retirement age than ever before. In fact, greater than 30% of the aforementioned 275 million VIO fall within 6-12 years old. We’re looking at potentially record numbers of cars hitting auto recycling streams. This is both good for the environment because of the benefits of auto recycling and creates a demand for consumers to replace their cars.

The growing segment of end of life vehicles will support the used car market in conjunction with other financial factors and consumer preferences. We will get into this more in a future Wreckonomics discussion.

Stay in this conversation with us as we navigate the always changing auto industry. You can find more of our Wreckonomics content by signing up to receive alerts on our blog below or following us on Facebook, Twitter and LinkedIn.