Lithium to Benefit Aluminum, Copper

Today, battery-powered vehicles represent only 2% of the consumer market, with lithium demand for batteries at about 175,000 tons annually. Manufacturers including Tesla, Chevrolet, and Nissan have plans to expand production significantly over the next five years, requiring more lithium, which is concentrated in a handful of locations in Chile, Argentina, and Australia.

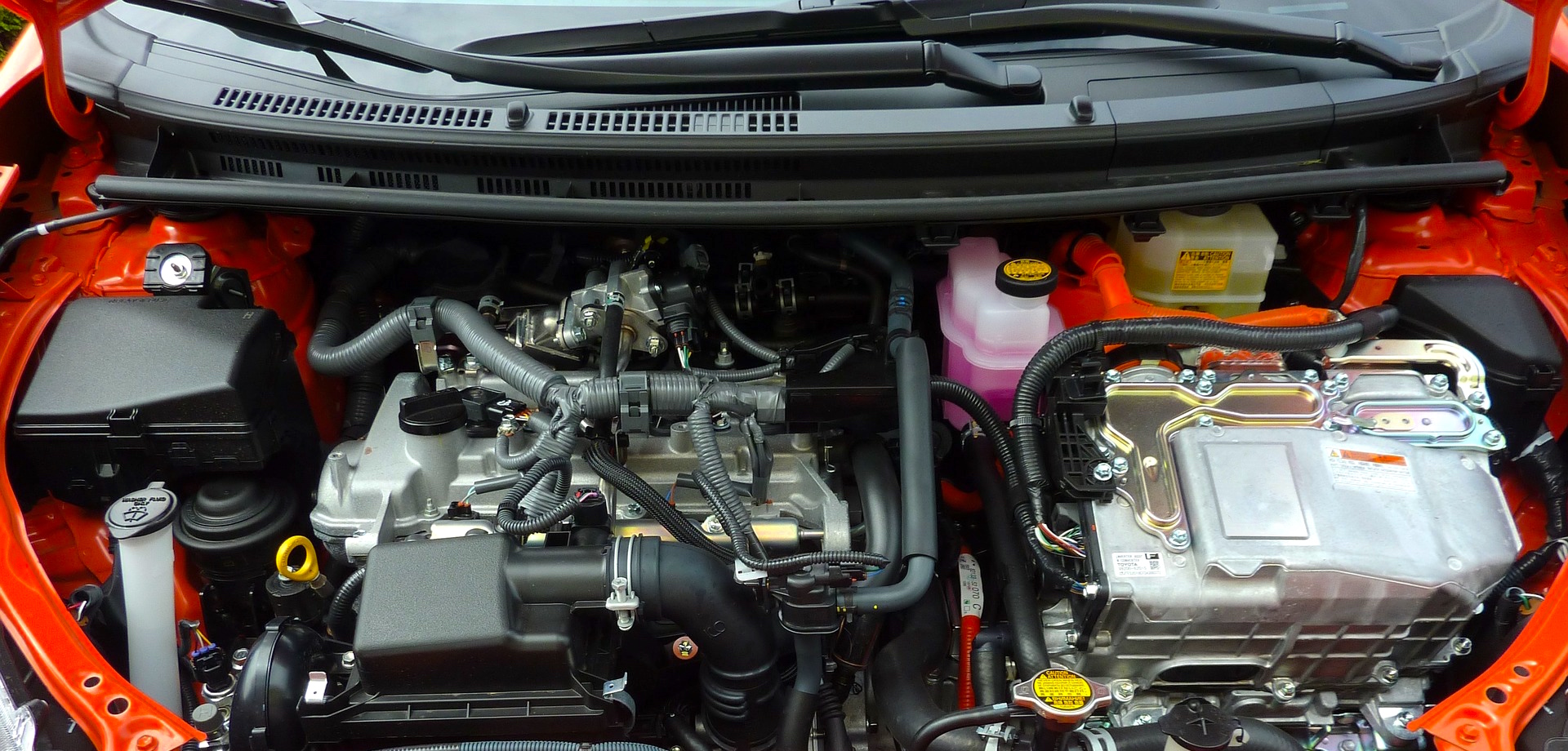

It isn’t just lithium that is experiencing what some analysts call the Tesla effect. Aluminum demand could gain from a development known as lightweighting, or substituting aluminum for steel to create lighter cars such as the all-aluminum body frame in Tesla’s Model S car.

Demand for copper, which is used as a conductor of electricity, also could rise. An electric car uses 60 kilograms of copper per vehicle, four times that of its diesel equivalent, according to producer Mantos Copper. 1

China is currently generating the largest demand, with a government-backed effort to build lithium battery-powered buses and consumer vehicles. Because lithium prices are negotiated privately, rather than traded on an exchange, China represents fierce competition for U.S. companies seeking to secure large amounts of lithium carbonate. Prices increased 47% in the first quarter (vs 2015 average) of the year.

Lowered Demand for Platinum and Palladium

If lithium shifts the commodities market, some metals will not benefit from the growing trend toward electric vehicles. Metals used in heavier vehicles and combustion engines will no longer be needed by manufacturers.

At the same time, demand for platinum and palladium could ebb, analysts say. These metals are largely used in catalytic converters to filter diesel fuel emissions, and have no use in battery-powered electric cars.

As the new vehicle marketplace grows to embrace renewable technologies and sustainability, conventional vehicles will be traded in and donated, giving automotive remarketers and recyclers substantial opportunities.