Tesla Effect: Lithium to Lift Commodities

Lithium to Benefit Aluminum, Copper Today, battery-powered vehicles represent only 2% of the consumer market, with lithium demand for batteries at about 175,000 tons annually. Manufacturers including Tesla, Chevrolet, and Nissan have plans to expand production significantly over the next five years, requiring more lithium, which is concentrated in a handful of locations in Chile,

Aluminum Use in Vehicles Increasing

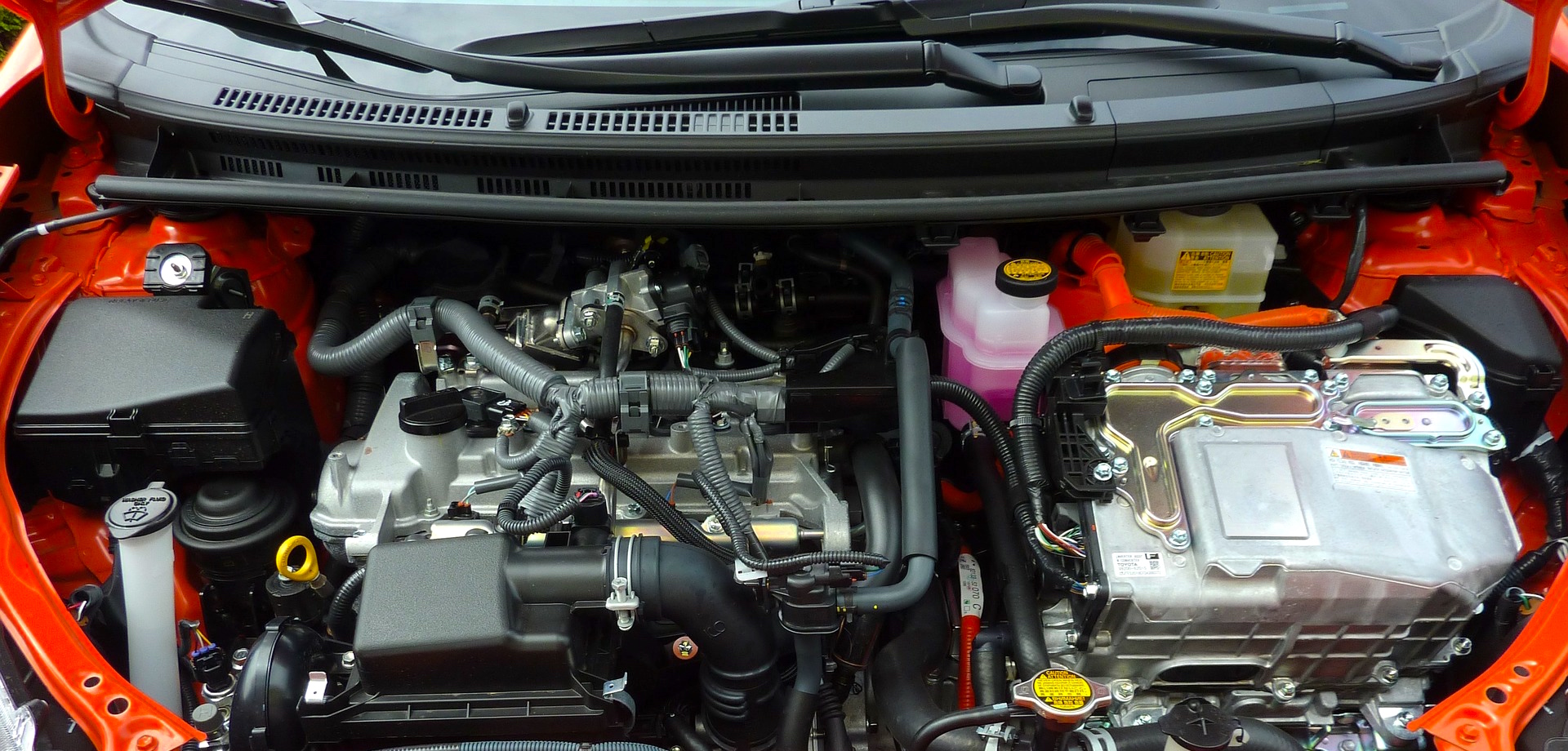

Aluminum Use on the Rise To convert vehicles to aluminum, Ford is estimated to spend $1 billion retooling its facilities in Dearborn, Michigan, and Kansas City, Missouri, said Vince Pavlak, a partner advisory at KPMG, who also spoke during the Wednesday session. Later this year, Ford is coming out with the all-aluminum Super Duty truck.1

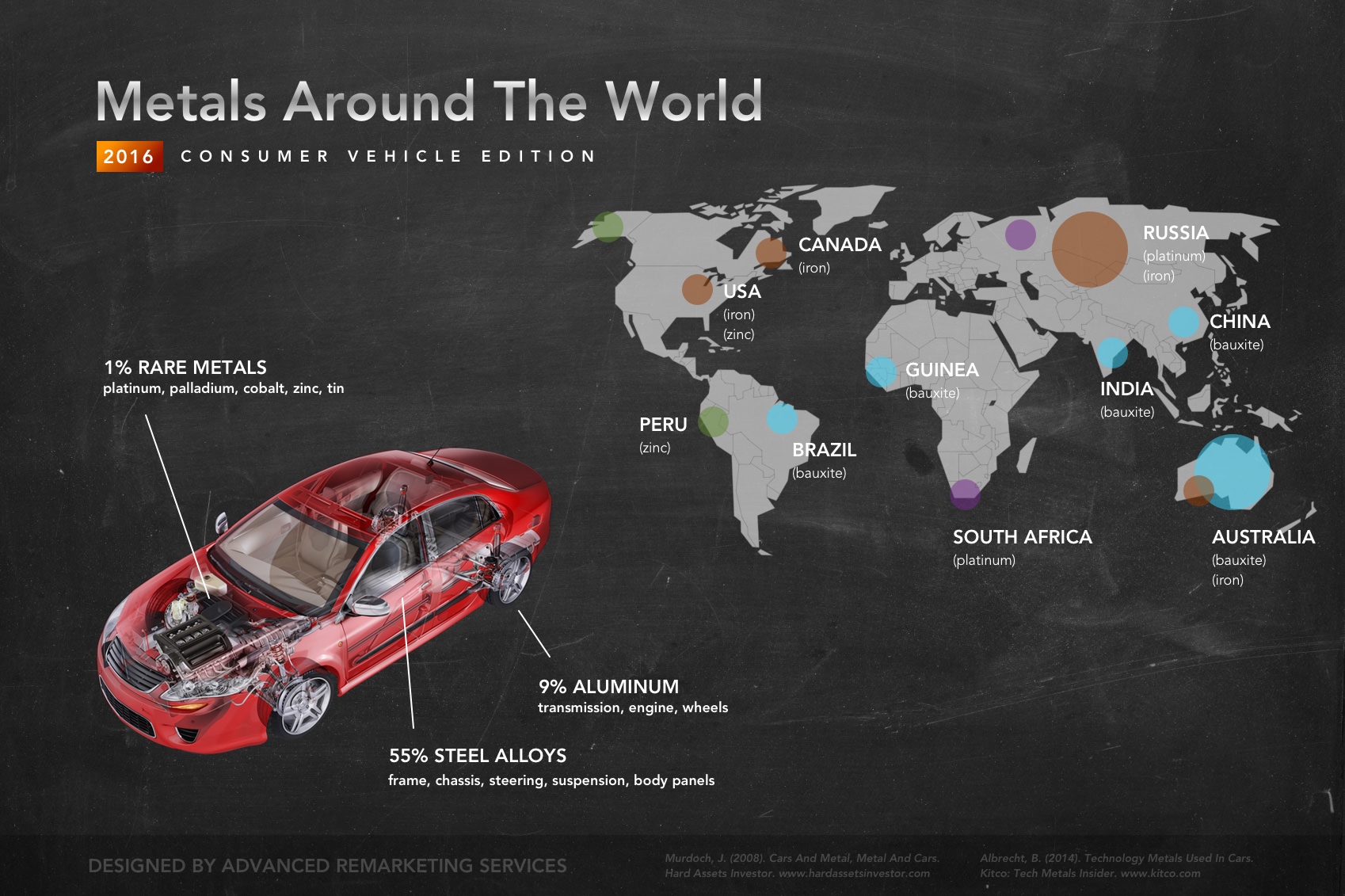

2016 Metals Around The World

2016 Metals Around The World: Consumer Vehicle Edition

WSJ: Scrap-metal sector is latest victim of commodities bust

From: Scrap-metal sector is latest victim of commodities bust By: John W. Miller PITTSBURGH—Cars are piling up at junkyards across the U.S., as the commodities bust that has already bruised mining and metals companies from Ohio to Australia ripples through another sector: scrap. As prices for steel, iron ore and other commodities have dropped because of a demand

Iron Ore Bludgeoned to Record Low in Asia on China Steel Concern

From: Iron Ore Bludgeoned to Record Low in Asia on China Steel Concern By: Jasmine Ng Iron ore contracts in Asia slumped to records amid speculation that mills in China are reining in steel production as they battle losses, slumping prices and tighter credit, hurting demand for the raw material that’s mainly shipped from Australia and

Aluminum and Copper Plummet

A hybrid of economic forces continues to reduce already depressed prices of metals, including gold, steel, copper, and now aluminum. “China’s stock market crashes again as panicking sellers lose faith” reads today’s headline, underscoring the gravity of weak demand while giving speculators cause to lower oil futures below $50 per barrel.1 Mining production has increased

Metals Tumble Following Greece, China Announcements

Greece Vote Against Austerity Measures Prices of copper and nickel dropped 4.2% and 3.3%1, respectively, following news of Greece’s vote against austerity measures and recent moves by China to prevent a stock-market collapse. The resounding “no” vote in Greece has signaled a potential exit from the euro, prompting market speculators to predict a significant slowdown

Palladium Follows Platinum Drop

Palladium prices dropped 15% this month, hitting a two-year low. Sources cite weak automotive demand in the U.S. and China – the automotive market accounts for 70% of annual consumption, used in catalytic converters. Mining has increased under the influence of a strong U.S. dollar, while demand has shrunk – this year’s demand is only

Steel Supply Chain Levels Out

Steel Supply Chain Decline “Have scrap steel prices finally found a floor?”1 The decline in steel prices is slowing as scrap markets look for signs of positive change. Late last month, the Commodity Trade Risk Management group published new prices for hot-rolled coil, which evened out at “$440/st, down from about $640/st last November”.2 CTRM