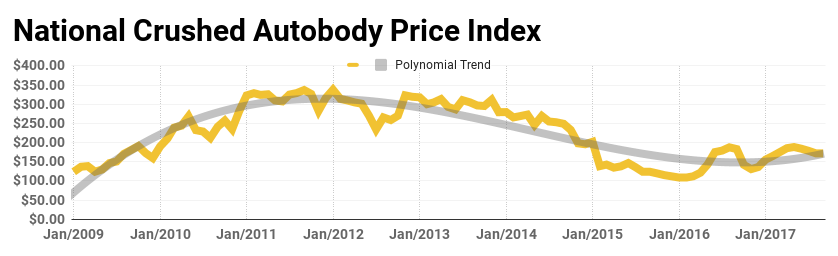

The scrap metal market in the U.S. stopped its slide after 3 months of consecutive decreases. However, we didn’t see an increase in the market as the national average price for crushed autobodies remained the same as our August report. Holding steady at near $172 per gross ton we still find the market 6% shy of the same time last year. After 14 consecutive months of improved year over year growth that saw the market improve an average of 32% each month, we’ve now had 3 months in a row that failed to match the previous year in value. This is something to keep an eye on going forward as the current scrap market has seemingly plateaued for the time being.

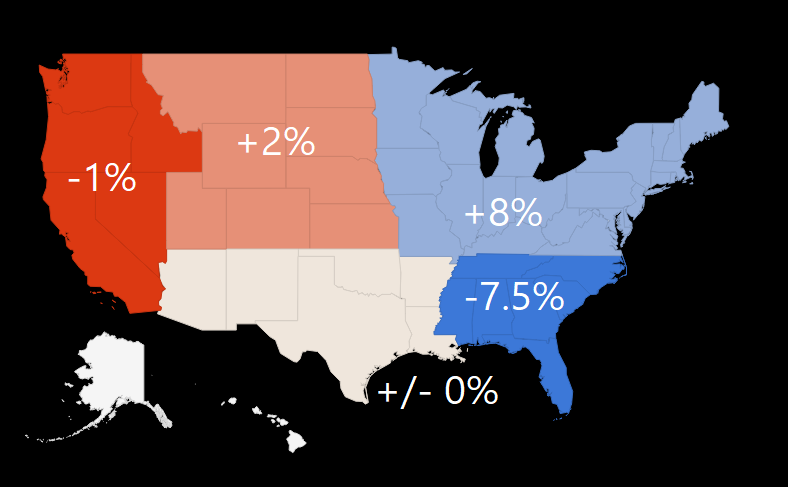

For the most part we haven’t seen a whole lot of variance in pricing in Zones 1 thru 3. Zones 4 and 5 however have proven to be a bit more volatile. This month scrap pricing in Zone 4 (Northeast) rose about $13 or 8% while Zone 5 (Southeast) dropped about $15 or 7.5%. In the last 5 months this is almost a 20% drop overall for the Southeastern area of the U.S. With the recent hurricanes in the region we may see prices gain back some ground as supply chains get interrupted. Zone 3, which includes Texas, had no change in the past month but we can expect some more significant movement in our next update.

“Houston is an important hub [for scrap metal], so the flooding is creating some real distortions in the supply chain,” said Joe Pickard, a chief economist at the Institute of Scrap Recycling Industries Inc.

“A supply wall like this coming to the market over a relatively small window of time will certainly pressure prices, barring any significant spike in steel demand,” said Nicholas Tolomeo, a managing editor with S&P Global Platts, a commodities price-tracking firm. –Scrapyards Steel for Impact on Prices After Hurricane Harvey, Wall Street Journal