China-U.S. trade war continues to affect the commodities market

Since our last report, the ongoing China-U.S. trade war, along with decreasing interest rates towards the end of 2018, are still causing industrial and auto companies to pull back strongly on spending. In recent months, the steel industry has suffered from holding high inventories throughout the system in 2019. In turn, going from high to very bare-bone levels usually causes a wide swing in demand and pricing for these commodity producers.

Fortunately, certain experts believe that steel prices have bottomed out. It’s not a certainty that steel prices will rise, but the low inventory situation gives reason for optimism. There are also suggestions that resolving uncertainty around the USMCA trade agreement, NAFTA’s successor, could help U.S. steel demand. The bill has one provision that 75 percent of U.S. automobile content has to be sourced from domestic manufacturers, while also containing stronger enforcement on sourcing and origination of steel, something both political parties are willing to pass.

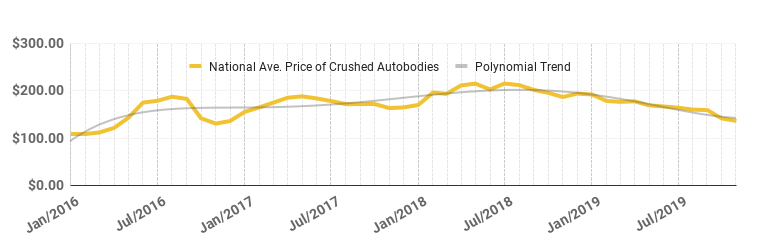

In this month’s report, scrap steel prices dropped by 3.53% making November the tenth month this year where prices have declined. Since September, the decrease in value overall has been well over $20/ton bringing the average price of scrap steel from crushed auto bodies to about $136/ton. Year-over-year the market has fallen over 27% as scrap steel was close to being priced at just under $190/ton in November 2018.

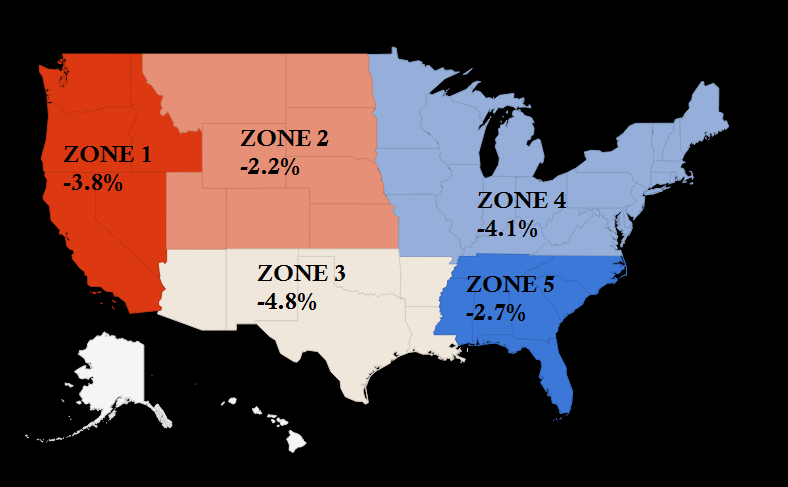

In the past few months, we have reported more significant decreases in different regions around the country than others. Specifically, in Zones 1 (West), 3 (Southwest), and 4 (Northeast). This month, across all zones, there are significant decreases in value. Scrap steel this month has dropped from a range of $3 to even $7/ton. Some of 2019’s lowest drops.

How electric vehicle development is affecting auto industry mining

Despite challenges, the automotive industry still has a major impact on the mining industry. The average car for example contains approximately 2,400 pounds of steel. Such demand has helped the steel sector grow in the last couple of decades yielding 3.6 million pounds of steel production on a per year basis. However, the relationship between these two industries has shifted since electric vehicles have entered the market, driving demand for completely different minerals. The electric vehicle market is expected to increase substantially in the next twenty years. Experts predict that nearly 40 percent of passenger vehicles in 2040 will be electric.

The demand for these key mineral components to make electric vehicles will continue to grow. The batteries of electric vehicles now account for 50% of the world’s cobalt demand. In addition to cobalt, the lithium and nickel mining industries are expected to boom too. But there is still a long way to go for the EV industry. First, raw materials for these batteries are extracted at a high labor cost, and a fairly large recycling challenge still looms over the 11 million tons of lithium batteries already produced that need to be discarded by 2030. So don’t expect this industry shift to rapidly develop and takeover anytime soon.