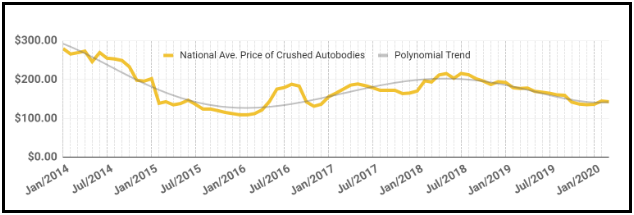

March scrap steel price drops amid coronavirus market scares

After two consecutive months of increased national scrap steel prices, the market has now dropped off slightly due to widespread global panic over the coronavirus. In March, the national price of scrap steel is now exactly $141, a decrease of 2.35 percent, or less than four dollars, mirroring the steel industry’s current concern with the state of the market. Looking year-over-year, the market has fallen just over 20 percent as scrap steel on average carried almost $36 more in value in March 2019 than it does now one year later.

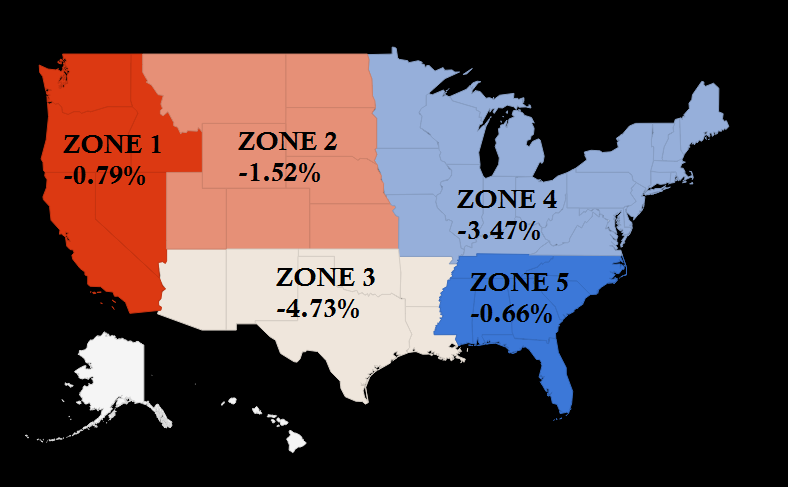

Regional price decrease fluctuated at varied dollar amounts in March. Zones 1, 2, and 5 decreased by no less than two dollars, while Zones 3 and 4 saw more significant decreases of eight and five dollars respectively.

Follow Up: How the Coronavirus Outbreak Is Continuing to Affect the Steel and Automotive Market

Over the past few weeks, global automakers and suppliers have been ‘scrambling’ to respond to the massive holes in their supply chain production caused by the coronavirus that broke out in Wuhan, China. At the time of the last Markets & Metals post, there had been more than 17,000 global cases confirmed. Since then, confirmed global cases have now increased by more than 400 percent (92,000 cases). Demand for new vehicles has nosedived, and US steel stocks have suffered from this and fallen sharply this year, but these struggles are not entirely their fault, or even China’s. Yes, industry experts might have predicted U.S. steel to slowly recover in 2020, but they weren’t able to foresee a global pandemic that would shake up two of the world’s largest economies. China is the second largest economy in the world, and the biggest consumer of commodities. As a result, the metals markets react when China experiences consumption issues.

Over the past few weeks, global automakers and suppliers have been ‘scrambling’ to respond to the massive holes in their supply chain production caused by the coronavirus that broke out in Wuhan, China. At the time of the last Markets & Metals post, there had been more than 17,000 global cases confirmed. Since then, confirmed global cases have now increased by more than 400 percent (92,000 cases). Demand for new vehicles has nosedived, and US steel stocks have suffered from this and fallen sharply this year, but these struggles are not entirely their fault, or even China’s. Yes, industry experts might have predicted U.S. steel to slowly recover in 2020, but they weren’t able to foresee a global pandemic that would shake up two of the world’s largest economies. China is the second largest economy in the world, and the biggest consumer of commodities. As a result, the metals markets react when China experiences consumption issues.

In the first half of February, new vehicle sales were down 92 percent according to the China Automotive Dealers Association. Experts are already predicting production to drop by 15 percent this quarter, which is roughly 1.7 million units of lost production per month. This is largely due to the fact that people in China aren’t leaving their houses or greeting car salespeople face to face. American companies are obviously very concerned by this. The automotive market is a capital-dependent industry that is attempting to operate without a major stockpile of parts, all while trying to determine whether information being relayed out of China is credible or not. The rapid spread of the coronavirus has dramatically disrupted the supply chain and lack of alternative solutions has quickly exposed this industry’s vulnerability. Jeep Wranglers for example, are being directly affected by this production slowdown. The Wrangler is assembled in Toledo, Ohio, but where do the steering gears come from? Wuhan, China. Former head of GM’s operations in Indonesia Mike Dunne simplified the complexity of this severe issue a few weeks ago when he said, “it only takes one missing part to stop a line. You can’t build a car with 99% of its parts”. Companies are losing millions of dollars by the week, but they do understand that they now need to find parts domestically or globally outside of China.

If there’s one takeaway from all of this, it’s that international companies with footprints in China that intend to remain competitive in their respective global market can use this situation to evaluate the strength of their risk management strategies, and realize how much more risk-averse they need to become. Smart companies like Apple and Microsoft are already starting to diversify by announcing plans to shift some production to Taiwan, Vietnam, and Thailand. Chinese automakers are doing the same. Shanghai Auto is starting to build cars and small SUV’s in Thailand and Indonesia, Great Wall Motors is buying plants in India and Thailand as well. For U.S. automakers and suppliers, you should follow suit. Check back in April for a follow up on this economic crisis.