While the scrap market slump lingers on it looks to stabilize with the possible completion of U.S.-China trade talks and the ongoing recovery of the Brazil mining disaster.

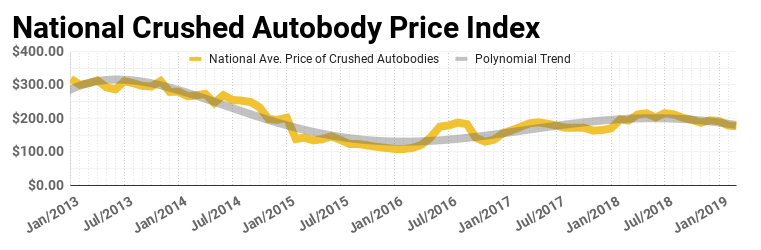

The scrap market has stabilized going into March relative to the February market report. Last months blog of course showed the largest decline in the National Crushed Auto Body Price Index since Q4 of 2016. This month the value of scrap steel still declined but it was a minor dip compared to the huge drop of last month.

The scrap metal market was down 1% compared to the previous month. While it’s a small drop, less than $2 per ton, it is still the 7th out of the last 8 months that has seen a decrease in value. At just under $177/ton, the value of scrap steel from crushed auto bodies is down almost 9% year-over-year. The scrap steel market is at its lowest average value nationwide since January 2018.

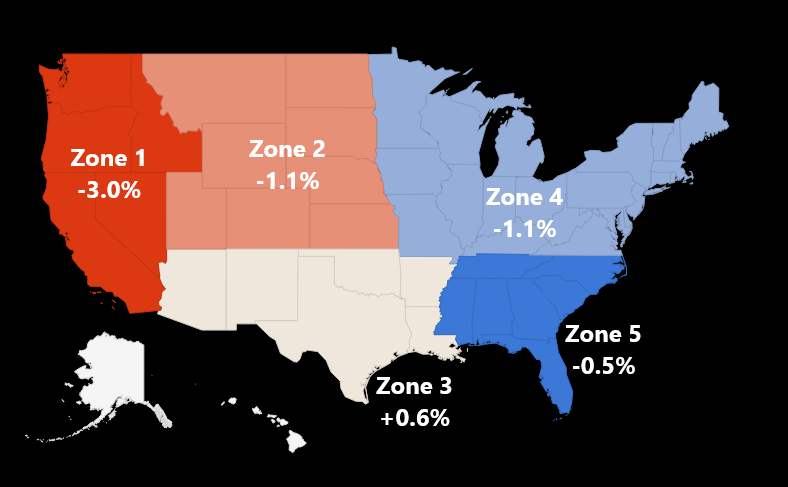

In a contrast to last month, the relative performance of scrap steel markets across the country was fairly even. Four of the five zones suffered a decrease, though the largest drop in value was Zone 1 (West) at just 3%. Last month decreases across the country varied from 2% to almost 14%.

Zone 3 (southwest) actually had a slight increase, albeit under 1%.

Scrap Market Zone Map – Regional Market Performance Compared to the Previous Month

U.S.-China Trade Talks May Be Nearing End Whether a Trade Deal is Made or Not

This afternoon, U.S. Trade Rep. Robert Lighthizer, made a statement on how the U.S. and China are marking progress on trade talks and we will know “before too long” if a deal is possible. It was reiterated too that the focus of the Chinese side is the removing of U.S. tariffs. By the next scrap metal market report we may know the final outcome of these negotiations so we will be following this closely. If steel and aluminum tariffs are removed as part of the deal it could impact prices the rest of the year and reopen up export channels for the U.S.

In other industry news, since the tragic collapse of a dam at Brazil’s Vale mine, China and other leading producers of steel have been looking at alternatives to the loss of iron ore supply. Some estimates were as much as 70 million tons of supply would be lost. The high-grade ore coming from Brazil has been the preference recently.

That disaster caused some problems for the ferrous market and certainly did not help the struggling scrap prices over the past few months. Some of the problems caused have since started to bounce back but as always we are watching the news for any updates both positive and negative.

Follow along with our blog for scrap market related posts or our coverage of the auto industry as it pertains to the used car market and auto recycling. Sign up for emails when a new post is live below and follow our social pages to join in on the conversation on Facebook or LinkedIn!