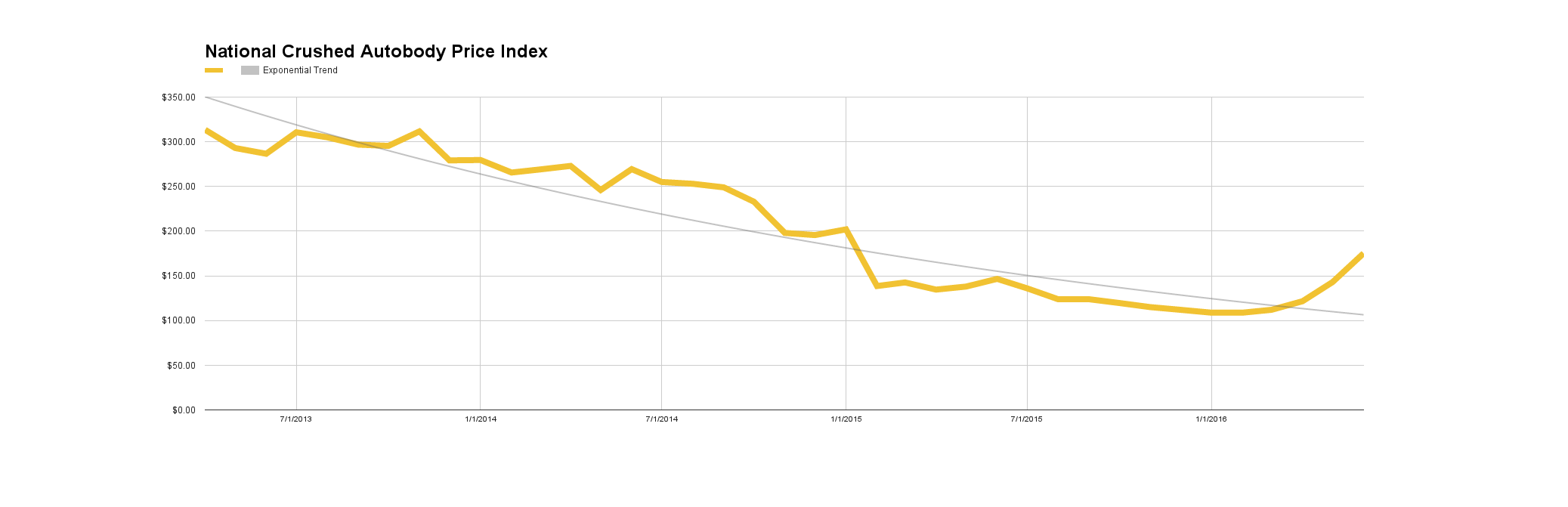

Scrap Metal Market Trends

Scrap metal prices for crushed autobodies continue to increase 22.52% over the past month (see May 2016 Scrap Metal Market Watch), and have grown 19.51% over the past year.

In May, government incentives for steel manufacturers in China were met with a strong response by the U.S. Commerce Department, which imposed tariffs – over 500% – on Chinese steel imports. Although the ruling by the Commerce Department is not expected to have an immediate impact, it represents a new paradigm in how the US actively shapes the metals market. Rumors that the International Trade Commission is considering a complete ban on all Chinese steel imports has also amplified focus on domestic prices and production.

Aluminum use in vehicles is also on the rise, with one estimate putting aluminum use at 547 pounds per vehicle by 2025. Ford is expected to spend $1 billion retooling its facilities in Dearborn, Michigan, and Kansas City, Missouri to produce aluminum-bodied vehicles.

Aluminum is also expected to benefit from the “Tesla Effect“, as lithium use by Tesla, Chevrolet, and Nissan lifts commodities including aluminum and copper. Because lithium prices are negotiated privately, rather than traded on an exchange, China represents fierce competition for U.S. companies seeking to secure large amounts of lithium carbonate. Prices increased 47% in the first quarter (vs 2015 average) of the year.

Advanced Remarketing Services offers innovative solutions to some of the remarketing industry’s toughest questions. We navigate the confusing landscape of wholesale, salvage, and consumer markets to see the vehicles in the best venue to the most appropriate buyer base.

NOTE: All figures are believed to be reliable and represent approximate pricing based on information obtained prior to publication. Advanced Remarketing Services is not responsible for the accuracy or completeness of the information provided, or for the use or application of information herein.