[avatar user=”zlasky” size=”thumbnail” align=”left” /]

The first Advanced Remarketing Services scrap metal market update in 2018 is a positive start to the new year. If you are a new reader of these monthly updates it is important to note each update is a review of the previous months performance. So this January update is taking a look at the scrap metal market in December 2017.

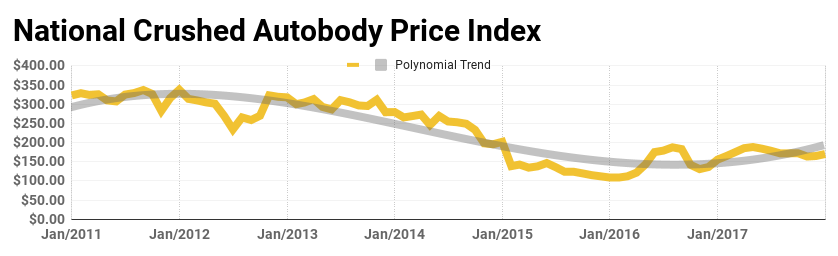

After a very slight increase in our last report, the national average price for crushed autobodies raised by over 3% in December. The average price per ton for a crushed auto body is now about $170. Compared to this time a year ago, that figure is over 9% higher. This is a bit lower than the 3 consecutive months of over 20% YOY increase that we just saw but still positive nonetheless.

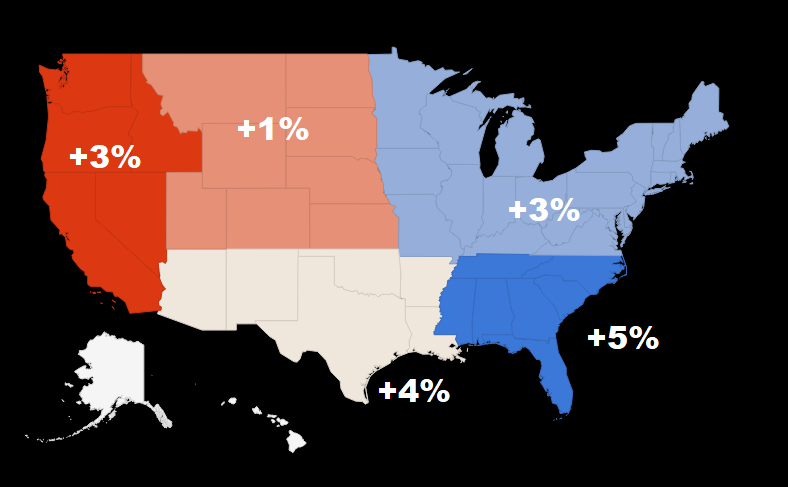

When we break it down by zones there is much more of an even balance going into 2018 than there was in 2017. There is only about a $25 difference between average scrap prices within the five zones. A year ago the difference between the highest average and lowest average zones was closer to $70. Zone 5 (southeast) had the biggest month to month increase at almost 5%. However, Zone 4 (northeast) remains the geographical area with the strongest market for crushed auto bodies.

The World Steel Association’s projection for 2018 is for moderate growth mainly due to the slowdown in China. Steel demand in the rest of the world should maintain its current momentum. Commenting on the outlook, Mr T.V. Narendran, Chairman of the worldsteel Economics Committee said,

“Progress in the global steel market this year to date has been encouraging. We have seen the cyclical upturn broadening and firming throughout the year, leading to better than expected performances for both developed and developing economies, although the MENA region and Turkey have been an exception… So, world steel demand is recovering well, driven largely by cyclical factors rather than structural. The lack of a strong growth engine to replace China and a long term decline in steel intensity due to technological and environmental factors will continue to weigh on steel demand in the future.”