Scrap steel prices are still struggling

Scrap steel prices are at an all-time low. As expected, the downward trend that began four years ago continues to hurt recycling rates, and recyclers struggling to make a profit. This price decline is in large part due to precious metals seeing a price increase while non-precious metals have seen a decline due to a number of factors, the largest issue being China. In its current condition, the commodities market cannot remain competitive with the presently-imposed tariffs and import duties. The blunt reality is that demand for scrap metal is still low right now. In some situations, current sales prices may yield a buy price that is potentially below the level at which it is economically beneficial for suppliers to even gather and attempt to sell scrap. Moreover, only larger recyclers can afford to hold on to inventory in hopes of a market uptick, while smaller and mid-size companies cannot.

While most recyclers are competing to differentiate themselves on value and price, the savvy ones are focusing on technology to improve efficiency, that way they’re not competing with margins. Data mining and container monitoring technology is one way recyclers are operating more efficiently. This allows haulers to identify full containers and collect at optimal times in order to avoid light loads and overweight hauls, helping them to better compete on price and keep collection costs lower. In sum, while it is not possible to predict the duration of these low prices, at least remain hopeful and expect an eventual recovery of some form soon.

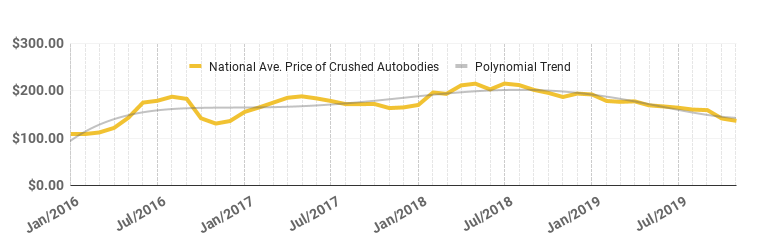

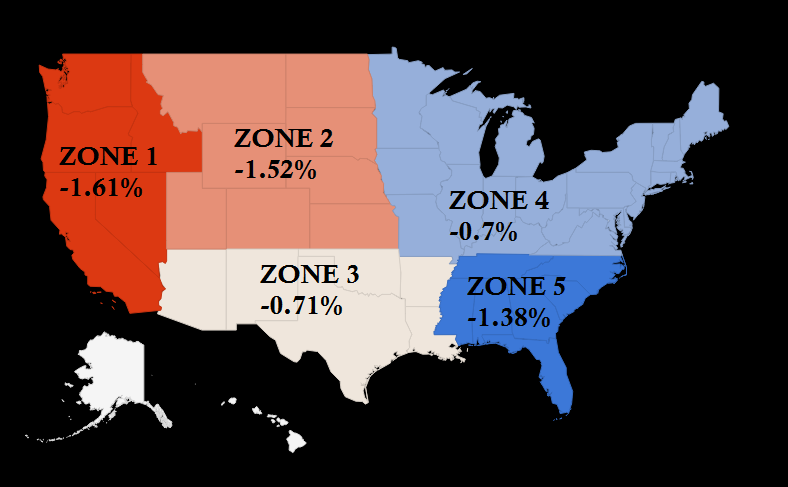

In this month’s report, scrap steel prices dropped only slightly by 1.17% nationally. In the last half of the year, the decrease of overall value on a month-to-month scale has been well over $20/ton. November’s post reported that the average price of scrap steel was $136/ton, however, not much has changed since that price has only decreased by $1.60 this month. Looking year-over-year, the market has fallen just over 30% as scrap steel on average carried $60 more in value in December 2018 than it does now one year later. In regard to regional price change, there is nothing particularly significant to report. No U.S. region’s average price dropped below 2%, or any more than $2/ton.

How the U.S.-China trade war is affecting more than just scrap steel prices

From September to October 2019, U.S. motor vehicle companies laid off approximately 41,600 employees. This included 21,000 in Michigan alone, the state that holds the highest share of automotive industry employment. This significant drop in employment is largely due to the 33 percent decrease of domestic export value to China, which resulted in a $1.2 million loss in vehicles and parts in the span of one month. As America’s largest manufacturing sector, the auto industry has always driven the American economy, especially Michigan’s. However, the U.S. continues to push China away, the world’s largest market of new vehicles.

Because this trade war has raised costs to manufacture vehicles domestically, and tariffs have increased by $190 per car, this has stirred up heavy panic among the Big 3 to start considering the costs of future plans and remain competitive in this international market. Concerns for jobs staying in the U.S. remain high. Before the trade war, export value to China dropped by $3.2 billion over nine months. In that same time frame, import value from Mexico to the U.S. increased by $15.5 billion. To steady prices and sales, many automotive manufacturers are turning to alternative countries with lower labor costs instead of moving back to the U.S., citing NAFTA as the main reason. It also doesn’t help that FCA US, Ford, and GM are also now starting to believe that battery builders are more essential than engine builders as the automotive industry is gradually starting to shift towards electric and autonomous vehicles. A specialized skill that most current employees in the industry are not equipped with. At this point, the U.S.’ focus remains the same, compete with China and hope this trade war ends soon, retain current employment, and manufacture vehicles at the most marginally beneficial rate.