Steel prices were up going into the last month of the year but are feeling pressures from falling oil prices, lack of exports overseas and slowing auto and housing industries.

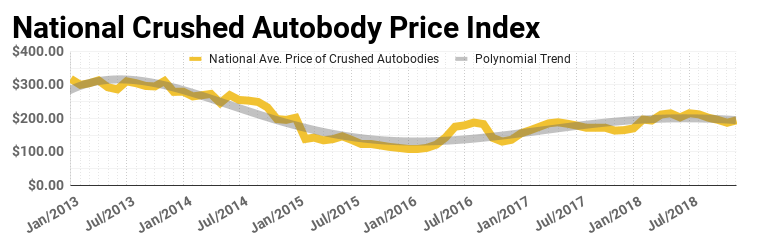

The December scrap metal report is ultimately a welcomed sight after four consecutive months of declines. While scrap steel prices were up and down in the previous month, the reported averages across the country resulted in a nearly 4% increase in gross price per ton of crushed autobodies. This average increase of about $13/ton helps the market finish the year almost 18% higher than the end of last year.

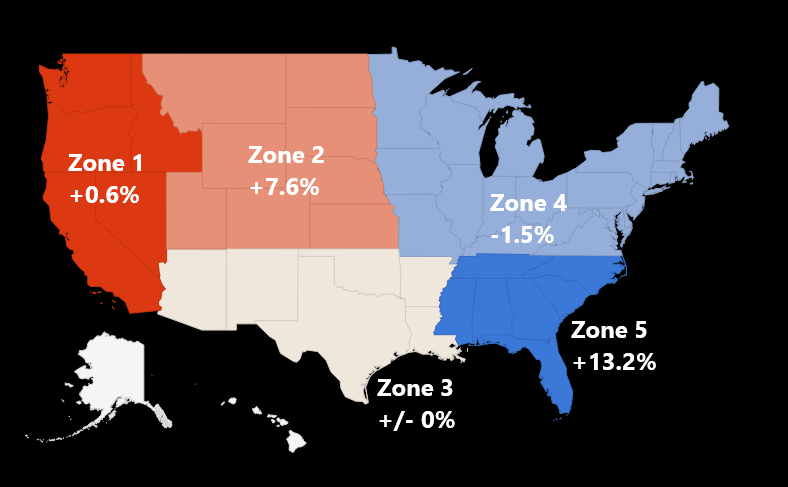

As noted the up and down prices across the country didn’t necessarily result in strong showings in every region. The largest average increases were seen in Zone 5 (southeast) and Zone 2 (northwest) where average price per ton for crushed autobodies increased 13% and 7.5% respectively. Zone 1 (west) and Zone 3 (southwest) hardly saw any net change and Zone 4 (northeast) actually had a slight drop in scrap steel prices.

What is causing the volatility of steel scrap prices?

The volatility of scrap prices and the markets in general is well known. Scrap steel itself had multiple swings in both directions in November and into December. There are multiple story lines to follow that may cause a bit of a pullback in the market. One is the price of oil hitting a 17 month low and while the U.S. has become a global leader in oil production there could be less of a demand for steel piping.

Politically tariffs have been in place now for much of the year. We saw prices rise dramatically but they may be now returning to a more sustainable level particularly with the threat of additional tariffs looming. We may be facing a logjam of oversupply domestically too as shipments overseas to China and Turkey have all but dried up.

Rising interest rates have played into slowing automobile and housing markets as well. After multiple years of growth both industries are slowing down and in such not requiring as much steel for production of materials. These industries of course are the largest users of steel domestically and greatly affect the demand for steel.

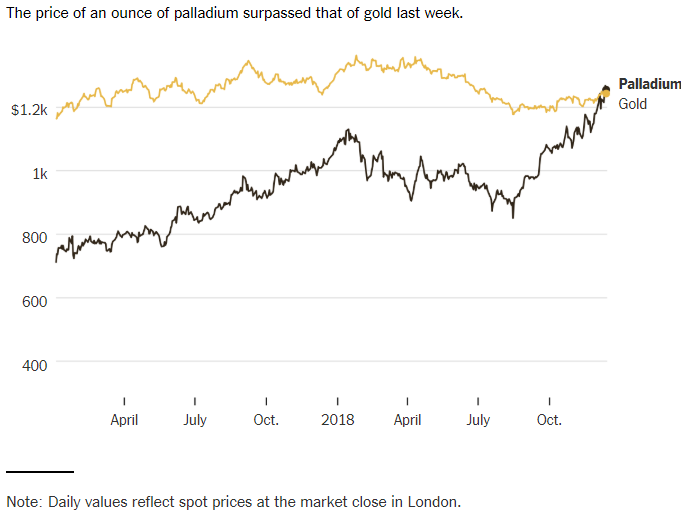

Industry News: Palladium threatening gold as most valuable precious metal

Palladium, a cousin of platinum, is one of the metals commonly found in catalytic converters to help vehicles control its output of pollutants. For the first time in 16 years, the value of palladium beat out gold – yes that gold. Over 80% of palladium supply is used in catalytic converters. It’s price has been driven up by auto sales and tight supplies from mines in Russia and South Africa. While palladium is at a record high we don’t expect to see much of a drop off while demand for the noble metal remains.

By The New York Times | Source: SP Angel

Looking to 2019

As we look ahead to 2019 the markets we pay attention to, anything revolving around the auto industry and auto recycling industry, remain as cloudy as ever. As mentioned scrap steel price volatility is being fueled by numerous factors and those – especially politically related factors – aren’t expected to figure themselves out early in 2019. Stay here for continued news and updates via Market & Metals and also tune in to our Wreckonomics™ series for intelligent conversations surrounding end of life vehicles.