The US-China trade deal continues to keep markets in a holding pattern as scrap metal markets slide further.

With the US-China trade deal still holding the metals markets hostage the scrap metal market report sees its fourth consecutive month of declines. Overall the scrap steel market hasn’t been taking huge hits, more of sliding slowly as each month without a deal goes by. This was seen last month where the market fell relatively evenly around the country falling just over 1.5% after a similar decline in June as well.

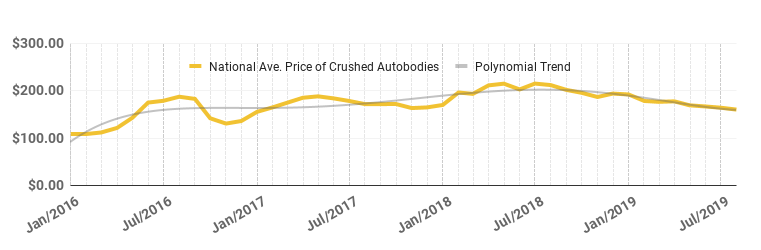

The value of scrap steel declined almost 2.5% heading into August setting a new low for 2019. The average price per ton of scrap steel from crushed auto bodies is down to about $160. This was a $4/ton decrease and closing in on an almost 25% drop year over year. In contrast, August 2018 was during the peak of scrap metal prices last year.

Scrap markets across the country were relatively stable except for in the southeast. Four of the five regions had values fall less than 2%. Zone 5 (southeast) saw scrap prices plummet 7.8%, more than triple any other region. The southeast region normally had one of the stronger markets for scrap steel but after this decrease markets fall in line with the rest of the country.

Industry News: US-China Trade Deal On Rocky Footing

The scrap metal market (and steel market in general) has been closely watching the US-China trade deal for pretty much all of 2019. Back in the January scrap metal market report we discussed the impending March 1st deadline to resolve the dispute. Now, two days ago an AP News article discusses the rocky relationship between the two countries.

“The US-China trade talks are in serious trouble,” said Wendy Cutler, a former U.S. trade negotiator who is now vice president at the Asia Society Policy Institute. “There is less and less trust on both sides, coupled with a growing sense in both Washington and Beijing that they may be better off without a deal, at least for the time being.”

With these trade talks threatening to go on indefinitely it seems as though there will be no relief coming soon for the metals markets. The next key date would be September 1st, which is when tariffs will go into effect on the remaining $300 billion of Chinese imports that have avoided the tax so far.