First Quarter 2022: Pandemic Metals Demand and Performance

For this quarter’s Wreckonomics/Metals and Markets overview we’re going to look solely at pandemic performance for the commodties and markets we discuss regularly. Let’s see if the narrow view tells us anything new.

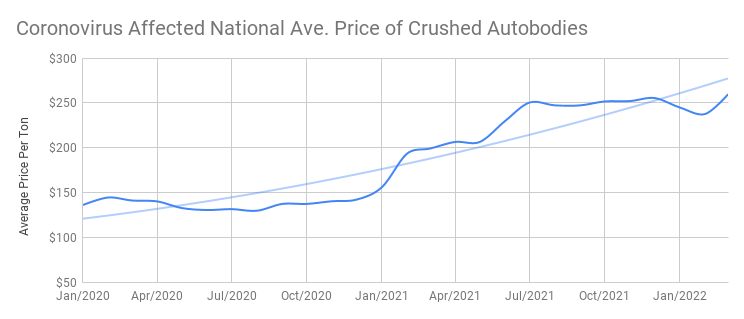

Crushed Auto Bodies

As discussed in previous Wreckonomics posts, Pandemic demand was totally fueled by Transportation Independence being an Issue of Public Health. After years of loosening ownership experiences, drivers fled from mass transit back to independent transportation.

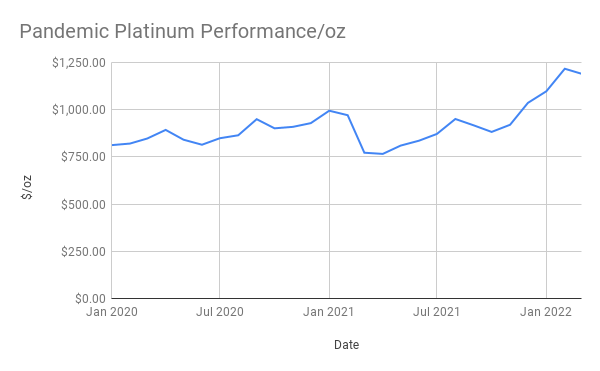

Platinum

Platinum’s gains haven’t been as well maintained, prices have fluctuated but remain above pre-pandemic starting point.

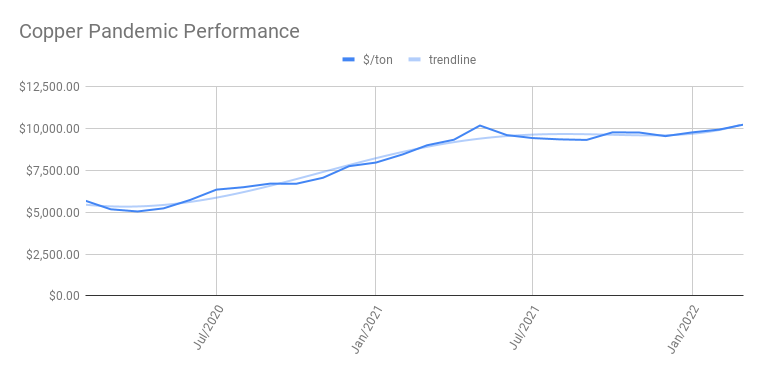

Copper

Despite recent softening Copper performance has stayed noticeably higher than pre-pandemic levels.

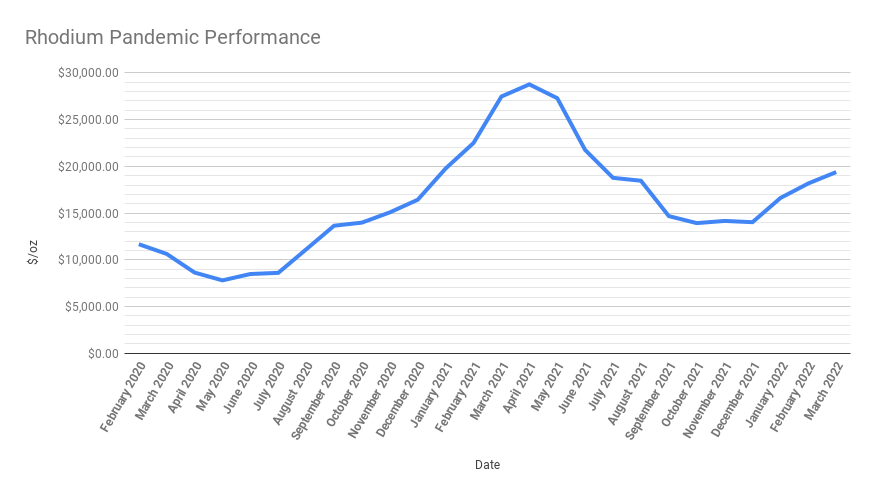

Rhodium

We enjoy watching Rhodiums insane performance. Some of the steep rise in rhodium demand happened before the pandemic window but the unforeseen heights were impossible to predict. The recent ‘mellowing’ isn’t expected to bring us back to prepandemic levels….

However, to put this in context, these recent decreases still leave Rhodium at over three and a half times the value in June of 2019 prior to the pandemic.

What Comes Next?

Inflationary pressures are showing up everywhere. March 22 has the U.S. economic feeling significantly uncertain of future markets. This narrow view of price performance tells a story of success but not many in the commodoties sector expect these successes to continue as before.