The U.S. reached an agreement with Canada and Mexico to end imposed steel & aluminum tariffs; scrap steel prices continue bad run in 2019.

The big news of May so far is the agreement between the U.S. with Canada and Mexico to remove the steel & aluminum tariffs applied to imports. On the other end of the industry the scrap metal market drops to a new low for 2019.

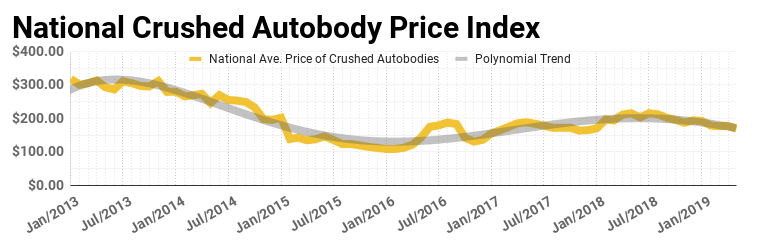

After last month was relatively stable for scrap steel prices, the market has started to struggle to hold its footing again. The average price of crushed auto bodies decreased by almost 5% month to month and is now over 21% lower than a year ago. It was nearly one year ago on May 31st when the steel & aluminum tariffs were originally announced. The scrap metal market has now dropped to a lower point than all of 2018 and 2019. Across the country the average price per ton for scrap steel is just over $169.

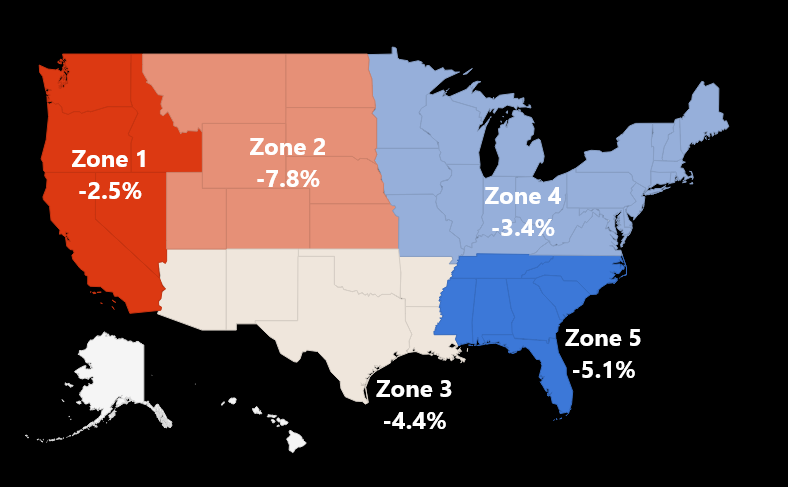

In the scrap metal market update each month, the value of scrap steel can vary across the nation. However, the market was consistent in this update in that each region decreased in value from the previous month. The biggest decrease was seen in Zone 2 (northwest), which was one of two regions that had increased last month, falling 7.8%.

Industry News: Steel & aluminum tariffs with Canada and Mexico to come to an end, iron ore price reaches a five-year high

As mentioned, this past weekend an agreement was reached between the U.S. and Canada and Mexico to end the tariffs on steel and aluminum imports. This agreement is a big step forward in allowing the revised trade agreement from last fall to be ratified into place. The USMCA or United States-Mexico-Canada Agreement is intended to replace NAFTA. This is particularly important for scrap steel and the auto industry because of the provisions included. In a previous update we highlighted what this would mean for domestic car production.

There has also been a recent surge in the price of iron ore all the way to a five year high. Iron ore, the main component to producing steel, is now up 38% in 2019. This boom in value has been attributed to the Vale mine collapse and subsequent closure in Brazil as well as an unexpected and significant increase in demand for steel in China.

Going forward the latest updates from within the steel industry may be able to help recoup some of the losses the scrap metal market has seen so far in 2019. We will be keeping a close eye on the market going forward and track performance throughout the rest of the year. As always feel free to give us a follow and share with your friends on Facebook and LinkedIn to stay in the conversation with us!